Amelia Park Neighborhood Real Estate Update - 2023, 2nd Quarter

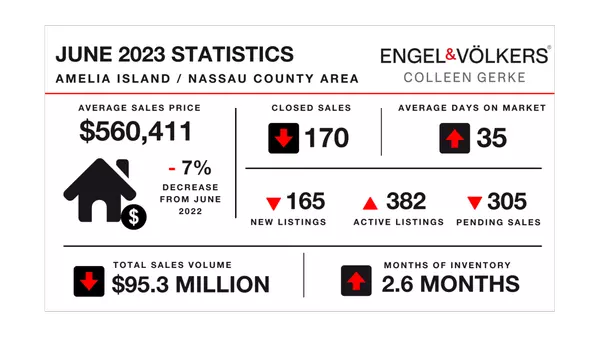

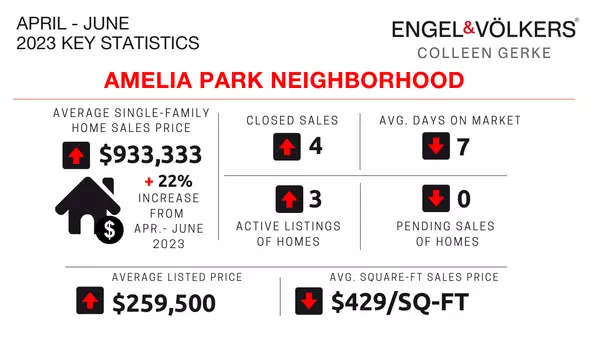

I love the Amelia Park Community in Fernandina Beach, FL and I’m apparently not the only one! While many places across the country are experiencing a decline in real estate prices, the Amelia Park community sure isn’t. In the second quarter of 2023, the average price of a single family in the Amelia Park Community was 22% higher than this time last year. As a Top Producer Realtor at Engel & Volkers First Coast here's your quarterly real estate market update for the Amelia Park neighborhood: Recent Home Sales in the Amelia Park Community in Fernandina Beach, Florida The following existing homes sold in neighborhood during the 2nd Quarter of 2023. *1767 Gardenia – Sold for $1,133,000 on 5/24/23 – MLS #104073 *1745 Howard – Sold for $900,000 on 4/17/23 – MLS #101309 *1531 Lakeview – Sold for $767,000 on 4/21/23 – MLS #104258 The town home sold in neighborhood during the 2nd Quarter of 2023. *1588 Park – Sold for $450,000 on 6/30/23 – MLS #104683 Top Producer Colleen’s Analysis: During the 2nd quarter of 2023, 3 single-family homes sold in the Amelia Park Community. The average sales price of these homes was $933,333, or $429/square-foot. This was approximately 22% higher than the average square-foot price of homes sold this time last year. One town home sold during the 2nd quarter of 2023 for a price of $450,000, or $272 per square-foot. Homes Currently Active for Sale in the Amelia Park NeighborhoodThe following existing homes are listed as Active for sale as of 6/30/34. *1567 Olmstead – Listed for $899,000, 43 days on market – MLS #104444 *1720 Heather – Listed for $820,000, 60 days on market – MLS #104257 *1512 Lakeside – Listed for $749,000, 54 days on market – MLS #104384 Top Producer Realtor Colleen’s Analysis:As of June 30, 2023 there are currently 3 homes listed as Active for Sale in Amelia Park. These homes have been on the market an average of 52 days. Their average price listed for sale is $822,667, or $444 per square foot. Vacant Lot Activity in the Amelia Park Community in Fernandina Beach, Florida The following vacant lot is Active for Sale in the neighborhood: *Northpark – Listed for $259,000, 91 days on market – MLS #103926 The following vacant lot is Under Contract in the neighborhood: *1532 Lakeview – Listed for $260,000 – MLS #103292 Top Producer Realtor Colleen’s Analysis: While no vacant lots sold in the Amelia Park community this past quarter, there is one vacant lot listed Active for Sale and one lot that is Under Contract. The lot that is Active for Sale is a 0.22 acre lot on Northpark Drive. The vacant lot that is Under Contract is a cottage lot, on the water, on Lakeview Lane. Curious how much your home in the Amelia Park neighborhood of Fernandina Beach, Florida is worth? Visit my web page devoted to the Amelia Park neighborhood at https://www.closewithcolleen.com/ameliapark Visit https://www.closewithcolleen.com/listing to search for a home in the Amelia Park neighborhood, or around Amelia Island and Fernandina Beach, Florida. Or feel free to call or text me at (904) 866-1211 or email me at colleen@closewithcolleen.com if I can help with any of your real estate needs in the Amelia Park community, or around Fernandina Beach, Amelia Island, Yulee, or Nassau County, Florida. ABOUT TOP FERNANDINA BEACH REALTOR COLLEEN GERKEColleen Gerke is a Top Producer Realtor in Fernandina Beach, Amelia Island, Yulee and the surrounding Northeast Florida area. Colleen has a top 5-Star rating on Zillow, Yelp, Realtor.com and Facebook. She strives to be the best real estate agent you’ve ever worked with! Whether you’re looking to sell your house in Fernandina Beach, move to Amelia Island, or add a Florida property to your rental portfolio, you’ll have a stress-free real estate experience when you Close with Colleen.*Home is not listed for sale by Colleen Gerke of Engel & Volkers First Coast

Take Time to Understand Your Insurance Coverage

Owning a home in the Amelia Island and Fernandina Beach area of Florida is a dream for many people. But with that dream comes the responsibility of protecting your investment with the right homeowner's insurance. One of the most important decisions you'll make when choosing a homeowner's insurance policy is whether to choose replacement cost coverage or actual cash value coverage. Here's a closer look at both options so you can decide which one is right for you: Replacement Cost Coverage Replacement cost coverage is the most comprehensive type of homeowner's insurance coverage. It reimburses you for the cost of rebuilding or repairing your home to its pre-loss condition, regardless of its current market value. For example, if your home is worth $700,000 and it burns down, replacement cost coverage would pay for the cost of rebuilding your home to its original condition, even if the cost of construction has increased since you bought your home. This type of coverage is ideal for homeowners who want the most comprehensive protection for their home. It's also a good choice for homeowners who live in areas that are prone to natural disasters, such as here in the Fernandina Beach and Amelia Island, FL area that is at risk of hurricanes and floods. Actual Cash Value Coverage Actual cash value coverage reimburses you for the depreciated value of your home. This means that the reimbursement amount will be reduced to account for the age and wear and tear of your home. For example, if your home is worth $700,000 and it burns down, actual cash value coverage would pay you the depreciated value of your home, which may be less than $700,000. This type of coverage is typically less expensive than replacement cost coverage. However, it doesn't provide as much protection. If your home is old or has a lot of wear and tear, you may not be reimbursed enough to rebuild your home to its pre-loss condition. Which Type of Coverage is Right for You? The best type of homeowner's insurance coverage for you will depend on your individual circumstances. If you want the most comprehensive protection for your home, then replacement cost coverage is the best option. However, if you're looking for a less expensive option, then actual cash value coverage may be a better choice. Here are some factors to consider when making your decision: The age and condition of your home Your budget Your risk tolerance The location of your home If you're not sure which type of coverage is right for you, talk to a trusted insurance broker. They can help you compare different coverage options and find the best plan for your needs. As a top realtor in Amelia Island and the Fernandina Beach, Florida area, I would be happy to connect you with an insurance broker who can help you compare different coverage options and find the best plan for your needs. Contact me today to learn more. ABOUT TOP FERNANDINA BEACH REALTOR COLLEEN GERKEColleen Gerke is a Top Producer Realtor in Fernandina Beach, Amelia Island, Yulee and the surrounding Northeast Florida area. Colleen has a top 5-Star rating on Zillow, Yelp, Realtor.com and Facebook. She strives to be the best real estate agent you’ve ever worked with! Whether you’re looking to sell your house in Fernandina Beach, move to Amelia Island, or add a Florida property to your rental portfolio, you’ll have a stress-free real estate experience when you Close with Colleen.

What is a homebuyer's rebate?

A homebuyer's rebate is a discount on closing costs that is offered by some lenders. This can be a valuable savings for buyers, especially in competitive real estate markets like ours in the Fernandina Beach and Amelia Island, Florida area where closing costs can be high. However, it's important to read the fine print before accepting a homebuyer's rebate, as there may be restrictions on how it can be used. How Do Homebuyer's Rebates Work? When you buy a home, you'll have to pay closing costs. These costs can include things like appraisal fees, title insurance, and recording fees. The amount of closing costs will vary depending on the state you're buying in and the type of loan you're getting. A homebuyer's rebate is a percentage of the closing costs that is paid back to you by the lender. For example, if you get a 2% homebuyer's rebate and your closing costs are $5,000, you'll get a $100 rebate. How to Get a Homebuyer's Rebate Not all lenders offer homebuyer's rebates, so you'll need to ask about them when you're shopping for a loan. Some lenders offer rebates to all borrowers, while others only offer them to borrowers who meet certain criteria, such as having a good credit score or using a certain type of loan. As a top real estate agent in the Fernandina Beach, Florida area, I would be happy to connect you with a lender who offers rebates. Once you've found a lender that offers a homebuyer's rebate, you'll need to ask about the terms and conditions. Some lenders have restrictions on how the rebate can be used. For example, you may have to use the rebate to pay for closing costs, or you may have to use it within a certain time period. The Pros and Cons of Homebuyer's Rebates Homebuyer's rebates can be a great way to save money on closing costs. However, there are a few things to keep in mind before you accept one. Pros: Homebuyer's rebates can save you hundreds or even thousands of dollars on closing costs. They can give you more purchasing power, allowing you to afford a more expensive home. They can help you close on your dream home faster, as you won't have to worry about saving up for closing costs. Cons: Homebuyer's rebates may not be available to all borrowers. They may have restrictions on how they can be used. You may have to pay taxes on the rebate. Overall, homebuyer's rebates can be a great way to save money on closing costs. However, it's important to read the fine print before you accept one, so you know what the terms and conditions are. How to Find a Homebuyer's Rebate If you're interested in finding a homebuyer's rebate, there are a few things you can do. Ask me - your real estate in the Amelia Island and Fernandina Beach, Florida area! I would be happy to connect you a lender that offer rebates. Do an online search. There are a number of websites that list lenders that offer homebuyer's rebates. Contact lenders directly. You can call or email lenders to ask about their rebate programs. Conclusion Homebuyer's rebates can be a great way to save money on closing costs. However, it's important to do your research before you accept one, so you know what the terms and conditions are. By following the tips in this blog post, you can find a homebuyer's rebate that will save you money and help you buy your dream home. ABOUT TOP FERNANDINA BEACH REALTOR COLLEEN GERKEColleen Gerke is a Top Producer Realtor in Fernandina Beach, Amelia Island, Yulee and the surrounding Northeast Florida area. Colleen has a top 5-Star rating on Zillow, Yelp, Realtor.com and Facebook. She strives to be the best real estate agent you’ve ever worked with! Whether you’re looking to sell your house in Fernandina Beach, move to Amelia Island, or add a Florida property to your rental portfolio, you’ll have a stress-free real estate experience when you Close with Colleen.

Categories

Recent Posts